AIG Travel Guard Trip Insurance – 2025 Review

AIG Travel – Travel Guard – Review

8

Strengths

- Strong Insurance Partner

- Good Evacuation Coverage

- Broad Range of Plans

- Primary Medical Insurance

- Pre-existing Medical Condition Waivers

Weaknesses

- Entry Level/Midrange Plans have Low Medical Insurance Coverage

Sharing is caring!

Introduction

AIG Travel Guard is a trusted partner of TripInsure101.

In this review, we showcase AIG Travel Guard’s Essential, Preferred, Deluxe and Plus trip insurance plans.

With more than 25 years of industry experience, AIG Travel Guard is one of North America’s leading travel insurance plan providers.

Travel Guard specializes in providing innovative travel insurance, assistance and emergency travel service plans for millions of travelers and thousands of companies throughout the world.

All AIG Travel Guard policies include:

- Coverage for Trip Cancellation, Trip Interruption, Trip Delay

- Primary Medical Insurance and Medical Evacuation

- Waiver for Pre-existing Medical Conditions*

- Protection against carrier default or bankruptcy**

- Baggage insurance, baggage delay, travel delay and missed connection**

- AIG Travel Guard’s 24/7 worldwide customer service

- Notify and start a claim

- Travel medical assistance

- Emergency services

- Worldwide travel assistance

- Concierge and personal assistance

*All AIG Travel Guard policies include the Waiver of Pre-existing Medical Condition when you purchase the policy within 15 days of the Initial Trip Deposit or Payment

**AIG Travel Guard Essential includes Financial Default and Missed Connection when you purchase the policy within 15 days of the Initial Trip Deposit or Payment

Why Use AIG Travel Guard?

AIG Travel Guard helps leisure and business travelers solve problems like Trip Cancellation or lost baggage, and handle travel risks like Medical Insurance and Medical Evacuation.

Their global reach and quality service offer travelers the best possible assistance.

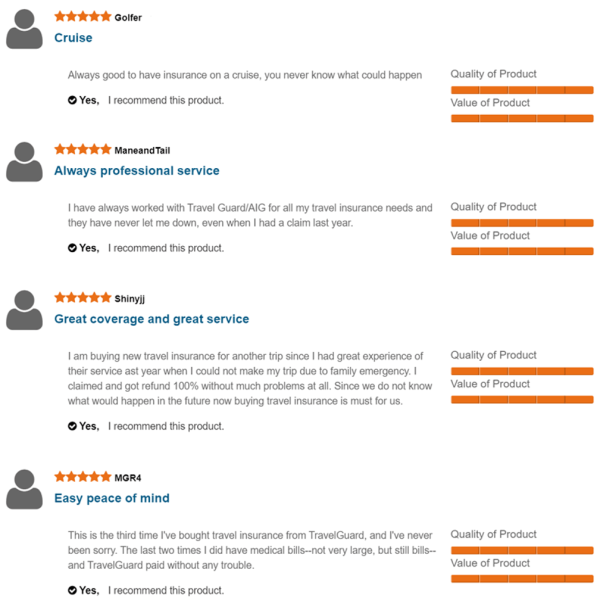

Travel Guard consistently receives high marks from its customers:

How is AIG Travel Guard Priced?

All four AIG Travel Guard plans in this review have dynamic pricing.

Dynamic pricing means AIG customizes the insurance price based on the traveler’s state of residence, age, trip cost, trip duration, and length of time between policy purchase and date of travel. As a result, pricing can fluctuate from day-to-day.

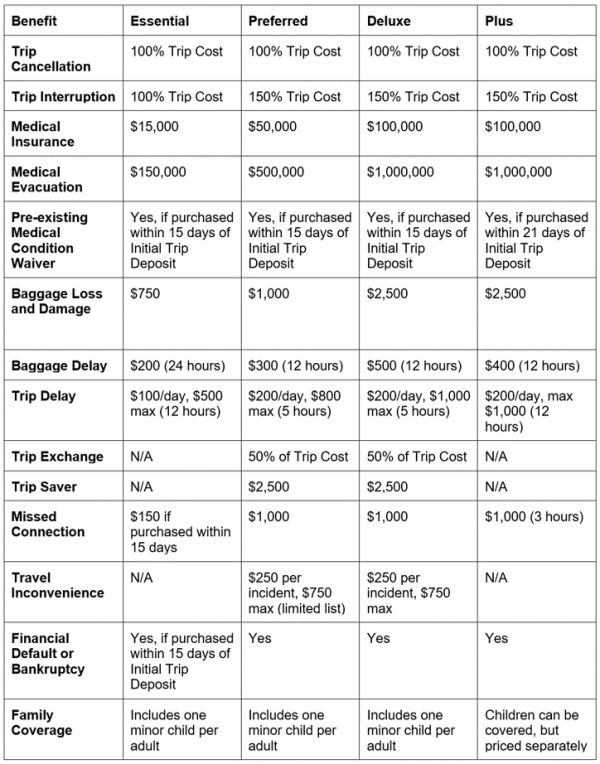

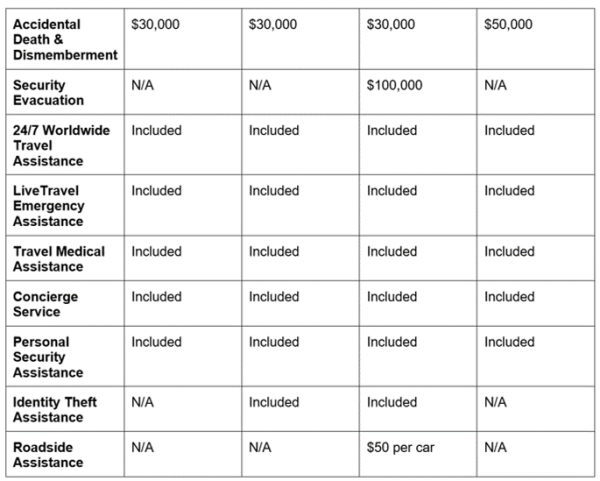

Side-by-Side Comparison of Travel Guard Plans

All benefits are per person.

AIG Travel Guard Essential

The AIG Travel Guard Essential is a basic trip insurance policy for travelers and families who want reliable domestic travel insurance coverage and access to 24-hour emergency travel assistance services.

You’ll enjoy comprehensive coverage like Trip Cancellation, Trip Interruption, Baggage, Trip Delay, and a Pre-existing Condition Waiver.

Travel Guard Essential provides additional protection at no added cost within 15 days of initial trip payment. Buying early means you enjoy coverage for Pre-existing Medical Conditions, Missed Connection benefits, and Carrier Financial Default.

Travel Guard Essential is a good fit for business travelers and families staying within the lower 48 United States.

How Much Medical Insurance Do I Need?

We recommend travelers buy at least $100,000 Medical Insurance and $250,000 Medical Evacuation coverage when traveling abroad.

AIG Travel Guard Essential includes only $15,000 Medical Insurance and $150,000 Medical Evacuation. While those levels are suitable for domestic travel within the US, it is not enough to protect you overseas.

If you travel abroad, consider more robust policies like AIG Travel Guard Deluxe and AIG Travel Guard Plus. Each of those plans offers $100,000 Medical Insurance and $1,000,000 Medical Evacuation. They are best suited for international travel.

AIG Travel Guard Essential Benefits

Trip Cancellation

100%

Trip Cost up to $100,000 max

Trip Interruption

100%

Trip Cost up to $100,000 max

Trip

Interruption – Return Transportation Only

$500

Accident & Sickness Medical

Expense

$15,000

Emergency

Dental Expense

$500

Medical Coverage

Type

Primary Medical Insurance

Emergency Medical Evacuation

$150,000

Pre-existing Condition Waiver

Available when purchased within 15 days of initial trip deposit

Baggage & Personal Effects

$750

Baggage Delay

$200

after the initial delay of 24 hours

Travel Delay

$150

per day, $500 max

Missed Connection

$150,

included when purchased within 15 days of initial trip payment

Accidental Death &

Dismemberment

$30,000

Extra Coverage

The following benefits are included at no extra cost when you purchase AIG Travel Guard Essential within 15 days of Initial Trip Payment:

- Pre-Existing Medical Condition Waiver

- Missed Connection coverage

- Trip Cancellation and Interruption coverage due to Financial Default of an airline, cruise line, or tour operator (some exclusions may apply).

Read our in-depth review of AIG Travel Guard Essential.

AIG Travel Guard Preferred

AIG Travel Guard Preferred is a mid-range trip insurance policy offering wider protection than AIG Travel Guard Essential offers.

Preferred includes comprehensive coverage like Trip Cancellation, Trip Interruption, Baggage, Trip Delay, and a Pre-existing Condition Waiver.

The Preferred plan also includes innovative benefits like Trip Exchange, Trip Saver, and Travel Inconvenience.

Like the other AIG plans, if you purchase the plan within 15 days of initial trip deposit, Travel Guard Preferred covers Pre-existing Medical Conditions.

Travel Guard Preferred is a good fit for travelers and families staying within the United States or traveling abroad with a Medicare supplement paying up to $50,000 Medical Insurance.

How Much Medical Insurance Do I Need?

Because we recommend travelers buy at least $100,000 Medical Insurance and $250,000 Medical Evacuation coverage when traveling abroad, check with your private health insurance provider.

AIG Travel Guard Preferred includes $50,000 Medical Insurance and $500,000 Medical Evacuation. While we applaud the Evacuation coverage, the Medical Insurance falls short.

If your private health insurance includes coverage of at least $50,000 for international travel, the Preferred plan may be an acceptable supplement.

If you’re on Medicare or your medical insurance does not provide health insurance coverage outside the US, we recommend choosing a plan with at least $100,000 Medical Insurance built-in, like AIG Travel Guard Deluxe or AIG Travel Guard Plus.

AIG Travel Guard Preferred Benefits

Trip Cancellation

100%

of the trip cost, up to a maximum of $150,000*

Trip Interruption

150%

of the trip cost, up to a maximum of $225,000**

Trip

Interruption – Return Transportation Only

$750

Accident & Sickness Medical

Expense

$50,000

Emergency Physical Therapy

$2,000

Medical Coverage Type

Primary Medical Insurance

Emergency Medical Evacuation

$500,000

Pre-existing Condition Waiver

Yes,

if the plan is purchased within 15 days of initial trip deposit, and all

prepaid, non-refundable trip costs are insured

Baggage & Personal Effects

$1,000

Baggage Delay

$300

after a 24-hour delay

Travel Delay

$200

per day after a 5-hour delay, max $800

Travel

Inconvenience

$250 per incident, max $750

Missed Connection

$1,000

Trip

Exchange

50% of

the trip cost up to $75,000

TripSaver

$2,500

Accidental Death & Dismemberment (excluding flights)

$30,000

**The trip interruption benefit is determined by the amount of trip cancellation benefit purchased. All benefits are per insured person.

Extra Coverage

The following benefits are included at no extra cost when you purchase AIG Travel Guard Preferred within 15 days of Initial Trip Payment:

- Pre-Existing Medical Condition Waiver

Read our in-depth review of AIG Travel Guard Preferred.

AIG Travel Guard Deluxe

Travelers who want the highest level of travel insurance protection, medical benefits, and assistance services prefer AIG Travel Guard Deluxe.

Deluxe has the highest level of coverage like Trip Cancellation, Trip Interruption, Emergency Medical Insurance, Medical Evacuation, and Baggage insurance.

In addition, Travel Guard Deluxe covers Pre-existing Medical Conditions, carrier Financial Default, even Trip Cancellation due to job loss and other covered work reasons. It also includes innovative benefits like Trip Exchange, Trip Saver, and Travel Inconvenience.

With $100,000 Medical Insurance and $1,000,000 Medical Evacuation, Travel Guard Deluxe is an excellent choice for international travelers.

How Much Medical Insurance Do I Need?

We recommend travelers buy at least $100,000 Medical Insurance and $250,000 Medical Evacuation coverage when venturing beyond the United States.

Happily, AIG Travel Guard Deluxe includes $100,000 Medical Insurance and $1,000,000 Medical Evacuation. These levels are ideal for both international and remote adventure travel.

AIG Travel Guard Deluxe Benefits

Trip Cancellation

100% of trip cost up to a maximum of $150,000*

Trip Interruption

150% of trip cost up to a maximum of $225,000**

Trip Interruption – Return Transportation Only

$1,000

Accident

& Sickness Medical Expense

$100,000

Emergency

Dental Expense

$500

Emergency

Physical Therapy

$2,000

Medical Coverage

Type

Primary Medical Insurance

Emergency

Medical Evacuation

$1,000,000

Pre-existing

Condition Waiver

Available if purchased within 15 days of initial trip

payment date

Baggage &

Personal Effects

$2,500

Baggage Delay

$250, after a 24-hour delay

Travel Delay

Up to $200/day to a maximum of $1,000,

after 5-hour delay

Travel Inconvenience

$250 per incident, max $750

Missed

Connection

$1,000

Trip

Exchange

50% of the

trip cost up to $75,000

Trip Saver

$2,500

Accidental

Death & Dismemberment

$30,000

Security

Evacuation

$100,000

*The trip cancellation benefit is determined by the amount of your trip you elect to protect up to the maximum benefit stated above.

**The trip interruption benefit is determined by the amount of trip cancellation benefit purchased. All benefits are per insured person.

Extra Coverage

The following benefits are included at no extra cost when you purchase AIG Travel Guard Deluxe within 15 days of Initial Trip Payment:

- Pre-Existing Medical Condition Waiver

Read our in-depth review of AIG Travel Guard Deluxe.

AIG Travel Guard Plus

The AIG Travel Guard Plus plan caters to travelers who want top-shelf insurance coverage and assistance services.

AIG Travel Guard Plus uses dynamic pricing based on age of traveler, state of residence, trip cost, trip length, amount of time between the purchase of the policy and travel date, and destination.

Because destination can affect the price of Travel Guard Plus, it often is the lowest cost policy for remote destinations like Ecuador, Antarctica, Australia, and Africa. Destination does not affect the price of other AIG Travel Guard Plans.

International travelers going to any destination outside the US will find AIG Travel Guard Plus a great fit with superlative benefits.

The Plus plan covers Pre-existing Medical Conditions, carrier Financial Default, Trip Cancellation due to job loss and other covered work reasons.

How Much Medical Insurance Do I Need?

TripInsure101 recommends travelers buy at least $100,000 Medical Insurance and $250,000 Medical Evacuation coverage when venturing beyond the United States.

Happily, AIG Travel Guard Plus includes $100,000 Medical Insurance and $1,000,000 Medical Evacuation. These levels are ideal for both international and remote adventure travel.

Travel Guard Plus is often favored by travelers embarking on a world cruise.

AIG Travel Guard Plus Benefits

Trip Cancellation*

100%

Trip Cost up to $100,000 max

Trip Interruption**

150%

Trip cost up to $150,000

Trip

Interruption – Return Air Only

$1,000

Accident & Sickness

Medical Expense

$100,000

Emergency

Dental Expense

$500

Emergency

Physical Therapy

$2,000

Medical Coverage

Type

Primary Medical Insurance

Emergency Medical

Evacuation

$1,000,000

Evacuation Escort Maximum

$25,000

Pre-existing Condition

Waiver

Yes,

if the plan is purchased within 21 days of initial trip deposit, and all

prepaid non-refundable trip costs are insured.

Baggage Loss &

Personal Effects

$2,500

Baggage Delay

$400

after a delay of 12 hours

Travel Delay

$200

per day after a delay of 12 hours, max $1,000

Missed Connection

$1,000

Accidental Death &

Dismemberment (excluding flights)

$50,000

**The trip interruption benefit is determined by the amount of trip cancellation benefit purchased. All benefits are per insured person.

Extra Coverage

The following benefits are included at no extra cost when you purchase AIG Travel Guard Plus within 21 days of Initial Trip Payment:

- Pre-Existing Medical Condition Waiver

Read our in-depth review of AIG Travel Guard Plus.

AIG Travel Guard Travel Assistance

All Assistance Services listed below are not insurance benefits and are not provided by the Company.

AIG Travel Guard provides assistance through coordination, negotiation, and consultation using an extensive network of worldwide partners.

Expenses for goods and services provided by third parties are the responsibility of the traveler.

Travel

Medical Assistance

A menu

of services available for emergency medical requests, including prescription

replacement assistance, physician referrals, medical evacuations, and more.

Worldwide

Travel Assistance

Assistance

with any travel emergency or request for general travel information, including

lost, stolen or delayed baggage, replacing lost passport or travel documents,

emergency cash transfers, pre-trip travel advice, inoculation information and

more.

Emergency

Travel Assistance

24-hour

hotline to make emergency travel changes, such as re-booking flights, hotel

reservations, roadside assistance, and more.

Concierge

Services

Whatever

you need, whenever, wherever you need it, you can call on your own personal

assistant to help. Services include tee time reservations, restaurant referrals

and reservations, sporting or theater tickets, and more.

Personal

Security Assistance

Assistance

to help maintain personal safety and personal information while traveling.

Services include evacuation assistance, 24/7 access to security and safety

advisories and more.

AIG Travel Guard FAQ

How does trip cancellation and interruption coverage apply?

Trip Cancellation and Interruption insurance reimburses for forfeited, non-refundable, unused payments or deposits if the insured must cancel or interrupt their trip due to covered reasons. The interruption benefit may also include coverage for additional transportation expenses.

What else is typically included in a Travel Guard insurance plan?

In addition to trip cancellation and interruption, most travel insurance plans include coverage for trip delay, missed connection, baggage, and personal effects, baggage delay, medical expense, and emergency evacuation which includes repatriation of remains.

24-hour assistance services are included to help the traveler with things such as emergency medical assistance, lost baggage tracking, emergency cash transfer, emergency or last minute travel arrangements, assistance with replacing lost travel documents, and much more.

What is a Pre-existing Condition?

Illnesses or medical conditions are not considered Pre-existing if the illness or medical condition is controlled by medication that has remained unchanged in dosage throughout the 180-day time frame ending on the effective date, and no medical diagnosis, care, advice or treatment has been otherwise received.

Note that death resulting from a Pre-existing Medical Condition is covered.

Can the Pre-Existing Condition Exclusion be waived?

Yes.

The Company will waive the pre-existing medical condition exclusion if the following conditions are met:

- The plan is purchased within 15 days of initial trip payment; (Travel Guard Plus has a 21-day period instead of 15-day) and

- The insured is medically able to travel when the plan is purchased; and

- The amount of coverage purchased equals all trip costs (up to the maximum shown in the Schedule) including any subsequent arrangements made for the same trip. The Insured must update the coverage to include the additional cost of the subsequent arrangements within 15 days (21 days for Travel Guard Plus) of payment to the travel supplier.

Does the Baggage insurance include all items I take with me while traveling?

No, there are some items that are not covered by Baggage insurance.

The policy excludes artificial prosthetic devices, false teeth, any type of eyeglasses or contacts, sunglasses, contact lenses or hearing aids, tickets, currency, prosthetic devices, animals, and motor vehicles.

What if I buy it and decide the coverage isn’t right for me?

- 15 days from the effective date of your insurance; or

- Your scheduled departure date

If you cancel within the first 15 days, the company will refund your premium paid provided no insured filed a claim under this certificate.

The refund option may not be available in all states. Check the certificate for details.

If I already have medical coverage, why do I need to pay for it again within travel insurance coverage?

Many domestic health insurance plans have limited or no coverage for overseas travel. If you have an HMO-type health insurance plan, coverage limitations may also apply within the United States.

Check directly with your health insurance provider if you are uncertain of your coverage when away from home.

We recommend at least $100,000 Medical Insurance for overseas trips. AIG Travel Guard Deluxe and Travel Guard Plus both include $100,000 Medical Insurance per person.

Seniors should note that Medicare insurance does not cover you overseas and many Medicare supplement plans have low lifetime maximum payouts, as well as deductibles and co-pays.

What is the definition of a “Trip”?

Trip means a period of travel away from home to a destination outside the insured’s city of residence.

- The purpose of the trip is business or pleasure and is not to obtain health care or treatment of any kind.

- The trip has defined departure and return dates specified when the insured applies.

- The trip does not exceed 364 days; travel is primarily by common carrier and only incidentally by private conveyance.

- Trip must be overnight, and the destination must be at least 100 miles from the insured’s primary residence.

What if a trip is longer than 364 days?

Coverage applies for the first 364 consecutive days of a trip.

Coverage ends at 12:01 am on the 365th day of the trip.

When does insurance coverage begin?

Trip cancellation becomes effective at 12:01 a.m. standard time on the date following payment to the company of any required plan cost.

All other coverages (Trip Interruption, Travel Delay, Medical Insurance, Medical Evacuation, Baggage, etc.) will begin on the later of:

- 12:01 a.m. standard time on the scheduled departure date shown on the travel documents, or

- The date and time the insured starts his/her trip.

When does coverage end?

Trip Cancellation coverage ends on the earlier of:

- The cancellation of the insured’s trip; or

- The date and time the insured starts on his/her trip.

Will the plan reimburse for the single supplement if my traveling companion cancels?

If a traveling companion cancels and you are held responsible for a single supplement, you would be covered for the change in the per person occupancy rate if the reason for the cancellation was covered under the terms of the plan.

Can I buy travel insurance after an incident has occurred?

No.

Travel insurance coverage applies only to unforeseen issues that occur after the policy is in effect.

Insurance does not cover events that are no longer unexpected or unforeseen.

What if I need a proof of Medical Insurance to obtain a visa (a Schengen letter)?

Please call the AIG Travel Guard World Service Center at 1-800-826-1300 and a representative can provide you with this information.

How do I file a claim?

Call Travel Guard at 1-800-826-1300. The claims department is available Monday through Friday from 7am to 7pm CST.

A representative will start the claim with you over the phone and explain what needs to be provided in order to process your claim.

The form will then be mailed, faxed or emailed to you for signature and you will be asked to provide the appropriate documents.

Additional Policy Info

This is a brief outline of coverage. Restrictions and exclusions will vary from state to state due to law.

For a complete list of coverages, exclusions, and detailed information, please refer to the Certificate of Insurance.

For questions regarding coverage, services or to file a claim please call AIG Travel Guard toll free at 1-800-826-1300 (open 24 hours). If calling from outside of the United States, call 715-345-0505 collect for assistance.

You Will Always Get the Lowest Price at TripInsure101

What many people do not know is that they won’t find the same trip insurance plans anywhere else for a lower price.

In fact, travel insurance price certainty is due to anti-discrimination laws in the US.

Therefore, a trip insurance quote from TripInsure101 is the same price you would see from the insurance carrier direct.

We are not allowed to compete on price for ‘filed’ insurance products.

No one is.

That’s why you are guaranteed to get the best price from us.

How to Shop Your Travel Insurance Options

As always, at TripInsure101 we recommend that travelers consider travel insurance.

You can get an anonymous quote in seconds, and compare dozens of the top travel plans from many of the largest US travel insurers.

You’ll save time and money – and find the right travel plan for your needs.

Visit TripInsure101 first to see your options before committing to the first travel insurance policy you’re offered.

Stop by and have a chat, send an email or give us a call at +1(786) 751-2984 .

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

customer

Quick easy and met my financial goal

Quick easy and met my financial goal

Carol

Quick, easy and economical

Melanie was very knowlegeable about all the policies and very helpful in finding the right policy for use. We are extremely happy with the results. She mad the process so easy and easy to understand. We will do business with you the next time we need travel insurance. Thank you.

customer

Shanna was very professional

Shanna was very professional, informative and pleasant.